When going digital is mandatory, Pendo helps Q2 transform financial institutions

Contents

With banks and credit unions across the country adapting to the ‘new normal,’ Austin-based Q2’s mission to help them provide seamless digital banking experiences has never been more important.

Q2 powers online banking portals and mobile apps that bring hundreds of community financial institutions to digital parity with massive national banks. Historically, about 50% of bank customers visit digital banking applications. But during the crisis, that percentage has spiked, at times stressing the systems and requiring quick action and communication from the Q2 team.

Long a Pendo customer, Q2 turned to its Pendo dashboards to make sense of changes in usage and to launch an in-app messaging campaign. This helped banks adapt to swiftly changing circumstances and ensured Q2 could continue providing high-touch service to their customers.

“One of the things we noticed is our customers’ customers are being challenged on how they do their banking now,” says Michael Vasquez, product owner at Q2. “Having a product like Pendo to help walk them through that experience—our customers have been begging for an experience like this.”

Leveraging insights to understand usage

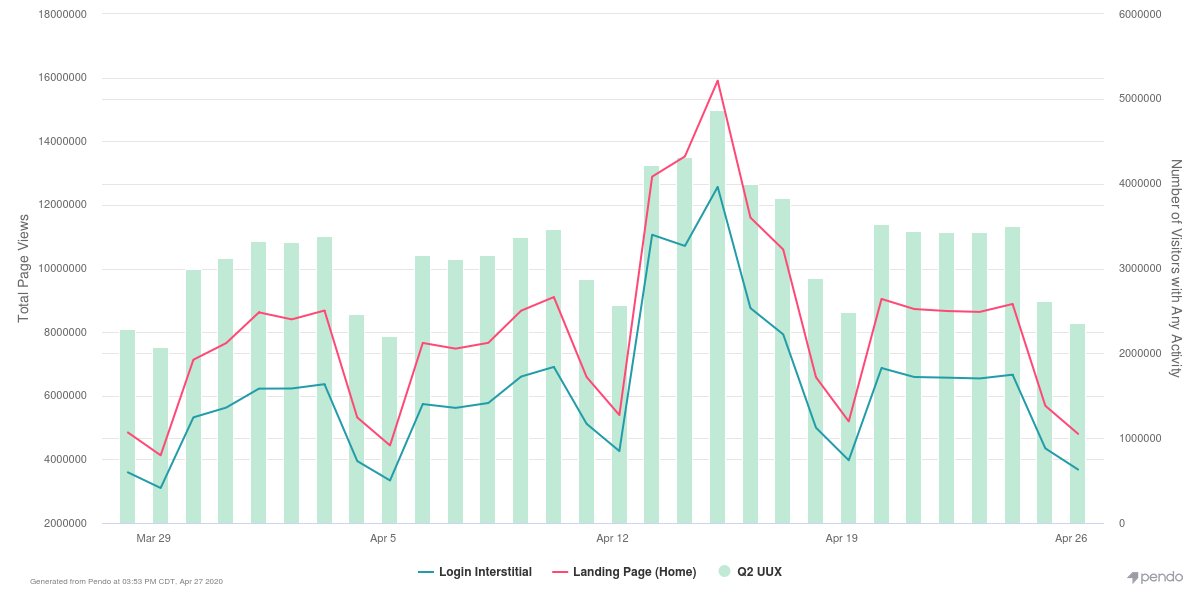

At first, the jump in usage that caused an outage appeared to be a potential distributed denial of service attack. But, using Pendo’s analytics, Vasquez quickly diagnosed the true cause: a surge in users trying to log in—double the amount normally seen on a Monday.

Vasquez was able to determine the cause by looking at usage of the banks’ and credit unions’ login, loading, and landing pages on Q2’s core web and mobile applications. As it turns out, the Monday of the increased activity was also the day federal stimulus checks began clearing into the bank accounts of millions of Americans. Everyone wanted to know if their check had arrived.

It wasn’t a cyberattack, as some at Q2 had feared—instead, it was an avalanche of account holder activity. Once the problem was identified, IT was able to add capacity to customers who had experienced the largest surges to make sure Q2 could absorb a repeat incident.

Accelerating digital transformation with in-app messaging

Covid-19 has forced many of the financial institutions that Q2 serves to accelerate their digital transformation initiatives—or for others, launch them from scratch. For many of their account holders, it represented their first digital banking experiences.

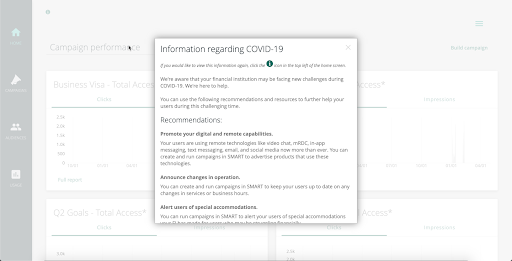

Early in the crisis, Pendo helped Q2 quickly communicate with banks in-app. Vasquez and his team deployed guides across Q2’s various apps, delivering information about virus-related changes and advice for financial institutions that found themselves suddenly navigating a new business landscape.

When businesses came to Q2’s customers seeking loans under the stimulus bill and were forced to carry out the whole process virtually, Vasquez and the Q2 team were able to use Pendo tooltip guides to walk users through digital loan applications, providing information about fields that many found confusing. What’s more, it was completed quickly — without requiring a line of code to be written.

Having a tool like Pendo to identify tasks or workflows that cause confusion or frustration for customers and guide them through the experience significantly increases the odds of a successful digital transformation for Q2’s customers, according to Vasquez.

Driving up product adoption and customer satisfaction with Guides and Insights

Q2 was able to adapt so quickly to the Covid-19 crisis thanks to a years-long investment in Pendo. The company originally brought the tool in for its analytics capabilities, vetting Pendo along with Mixpanel, Kissmetrics, Google Analytics, AppDynamics, and Heap. But Pendo’s retroactive analytics, the ability to use that data to segment and target users, and ease of designing guides without engineering help were the deciding factors in Q2’s selection.

Pendo’s in-app messaging and guidance capabilities made adding self-service support and onboarding new users with walkthroughs and tooltips simple for Vasquez’s team. In one case, a simple tooltip explaining the difference between a user’s “current balance” and their “available balance” was viewed 3,000 times and effectively eliminated one of the most commonly submitted support tickets.

“Having that ability to put that tooltip in, and having it only take 10 to 15 minutes, was huge to them,” Vasquez says.

Now, Q2 is using Pendo Adopt to offer its customers the ability to see their own usage analytics for their instance of Q2 and deploy in-app messaging to their own customers in a white-labeled instance. Vasquez and his team plan to start rolling Pendo out in other Q2 products soon.