Table of Contents

In a rush?

Download the PDF for later

Last year’s State of Product Leadership survey suggested a role very much on the rise, with PMs taking on more and more responsibility and reporting high job satisfaction. This year’s survey paints a decidedly different picture of what feels like a role in transition. We surveyed 300 product leaders who own or lead teams focused on software products. We asked about their responsibilities, effectiveness, organizational structure, career path, and satisfaction.

We found some surprising things:

- Unlike last year’s survey which painted the picture of expanding scope, PMs seem to have a more circumscribed view of their direct responsibilities and influence.

- What product managers do and how they measure success appears to be a step behind the new realities of SaaS and other business models dependent on recurring revenue.

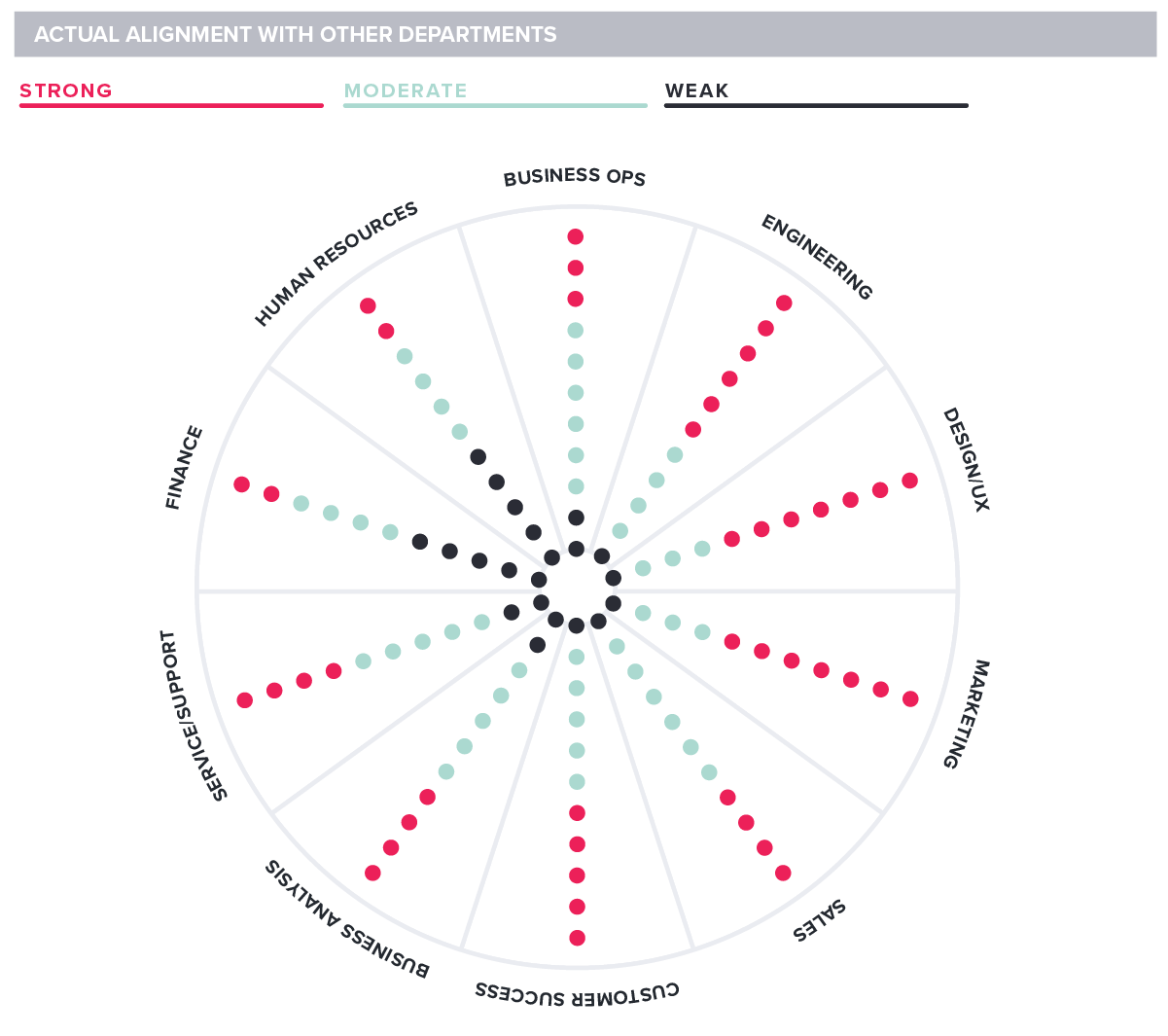

- PMs are more focused on alignment with design and go-to-market roles like UX, marketing, and customer success than with their core engineering constituents.

- Customer success and its central goal of customer retention appear to be a gap for PMs who report less alignment with this function and lower e ectiveness in contributing here.

This eBook discusses the key findings from our research, outlines a profile of today’s product leaders, and provides recommendations for how to apply these findings with your own teams.

Overview

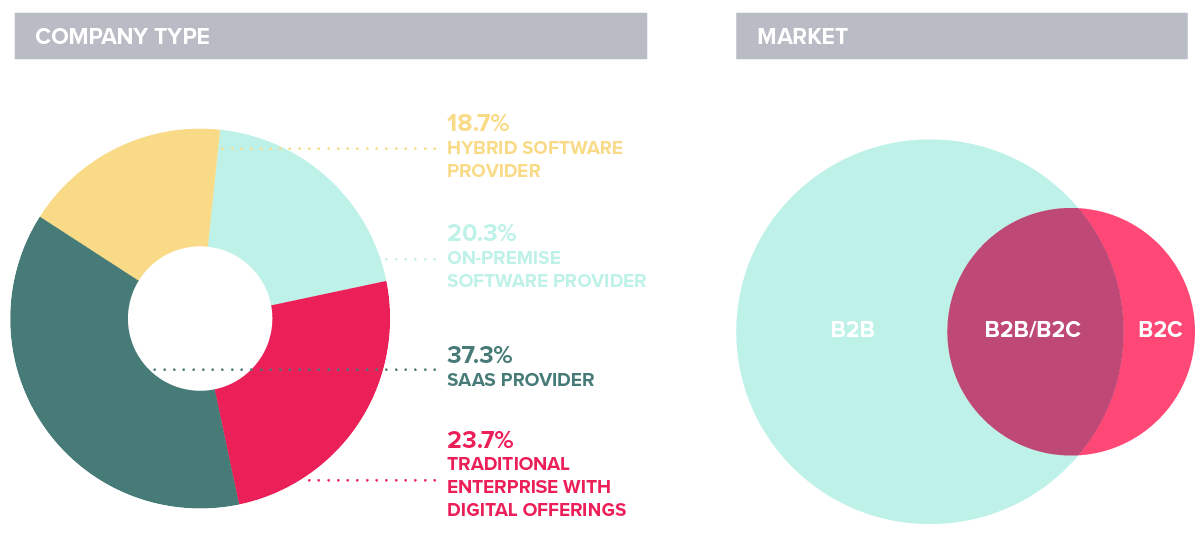

We surveyed 300 product leaders from digital product companies (both software companies and traditional enterprises).

The majority of respondents work for B2B SaaS companies, but we also surveyed a healthy sample outside of this core audience.

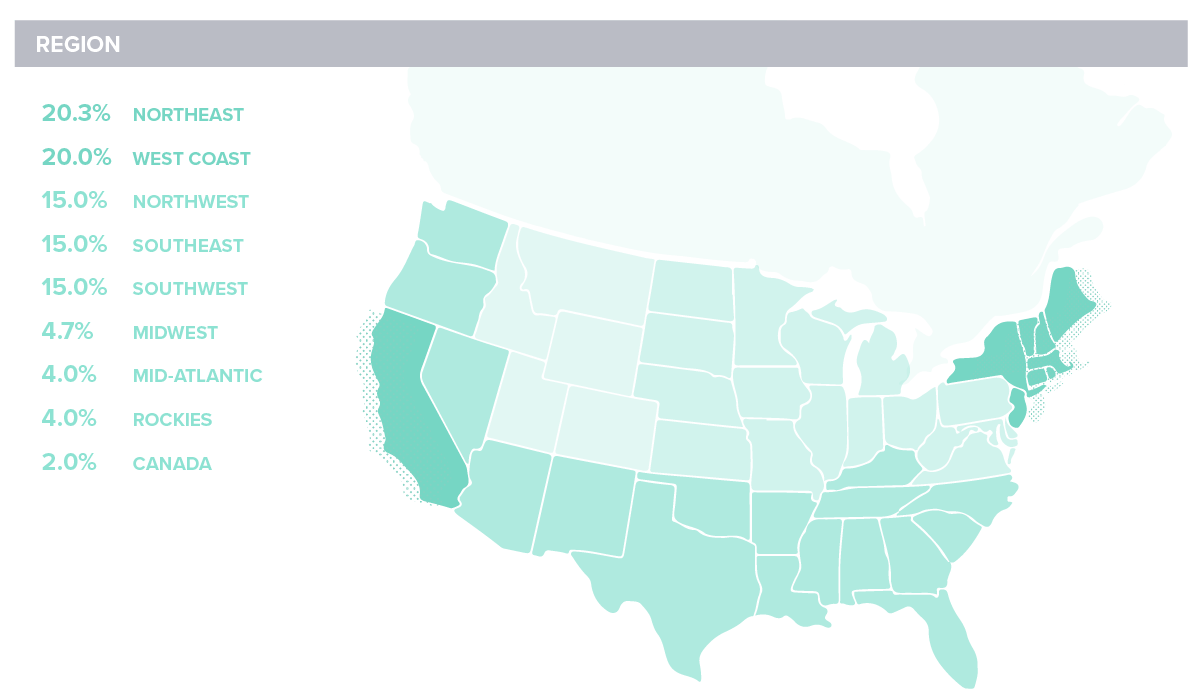

The survey focused primarily on North America with the majority of respondents hailing from tech-heavy regions like the Northeast and West Coast. Companies were evenly sampled across all sizes from <$25 million to over $1 billion in revenue.

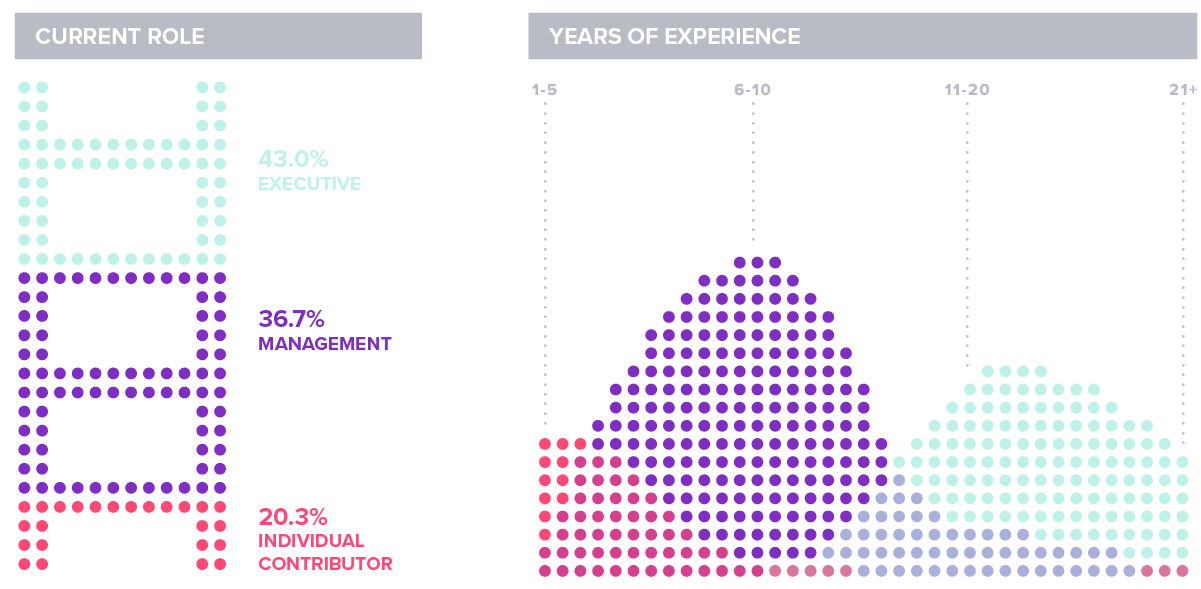

Profile of the Product Manager

The majority of respondents were true “product leaders” with either management or executive-level responsibilities and 6-10 years of product management experience.

Key Finding 1

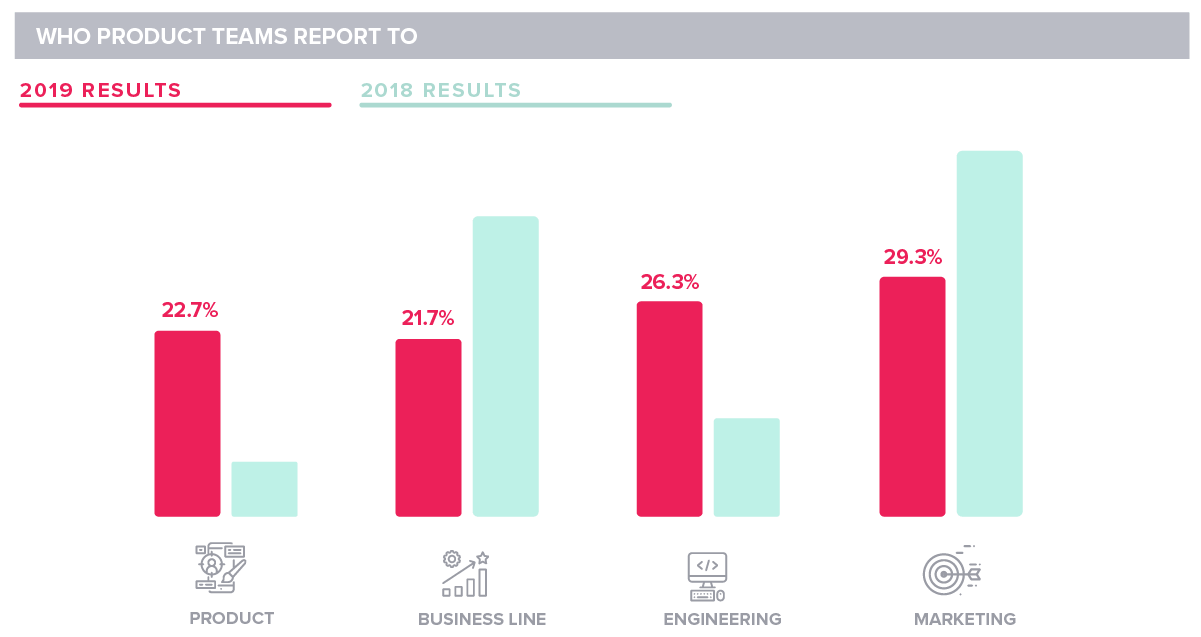

Product teams increasingly report into a chief product officer as PM reporting lines shift away from marketing.

One of the key markers of organizational maturity is the presence of a chief product officer as a senior executive with a seat at the table. Last year, only 6.7 percent of respondents said their company had a CPO, with marketing the predominant reporting line for the product team. This year, while marketing still holds an edge, it’s no longer commanding. Nearly 23 percent of respondents tell us that product reports into a CPO or equivalent, representing the most punctuated shift over the last year.

Also notable: the prevalence of product teams reporting to engineering has doubled, now second only to marketing as the expected reporting line.

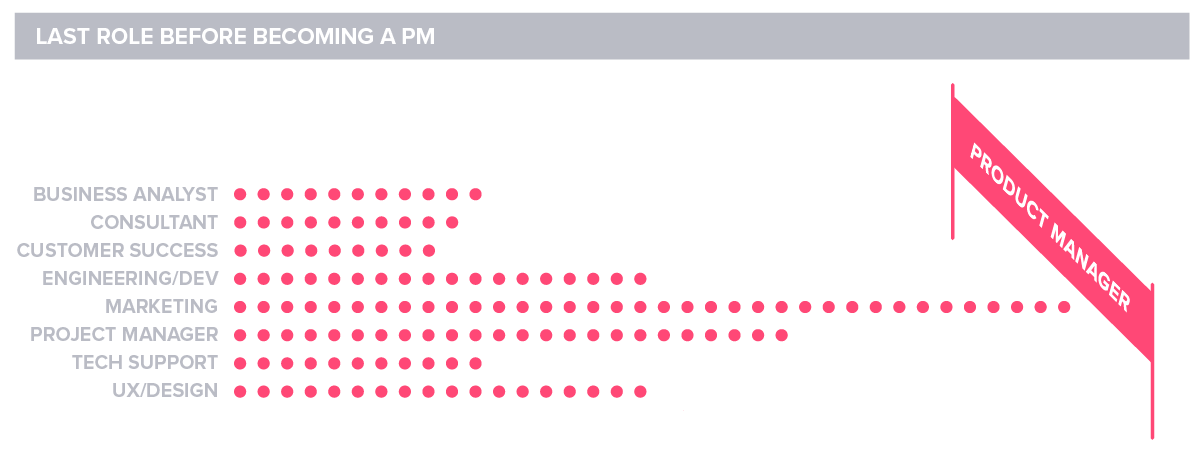

How do you get into product management? Our respondents tell us that marketing is the path to follow. Of course, as a discipline that’s only now starting to see formalized higher-ed curriculum, PMs have always been a relatively self-taught bunch—and there are many paths you can take.

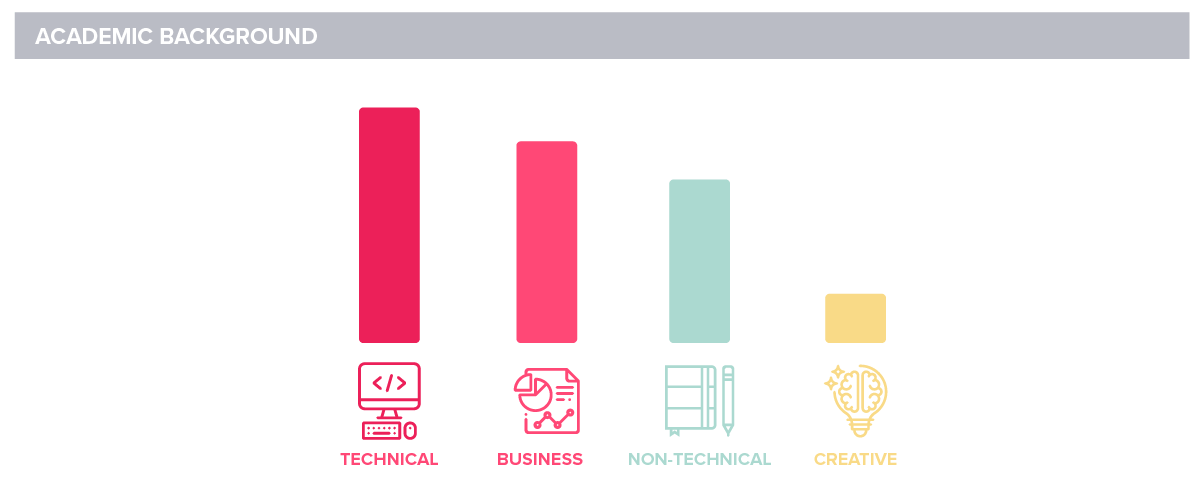

What did PMs study? While last year we found that slightly more product managers studied business, this year’s survey sounded a more technical note. But don’t worry if you’ve never written a line of code. There are many faces to a great product manager. We saw roughly even distribution between those with a technical background, those who studied business, and those who dabbled in the arts—liberal, fine, graphical, and otherwise.

Roles and Responsibilities

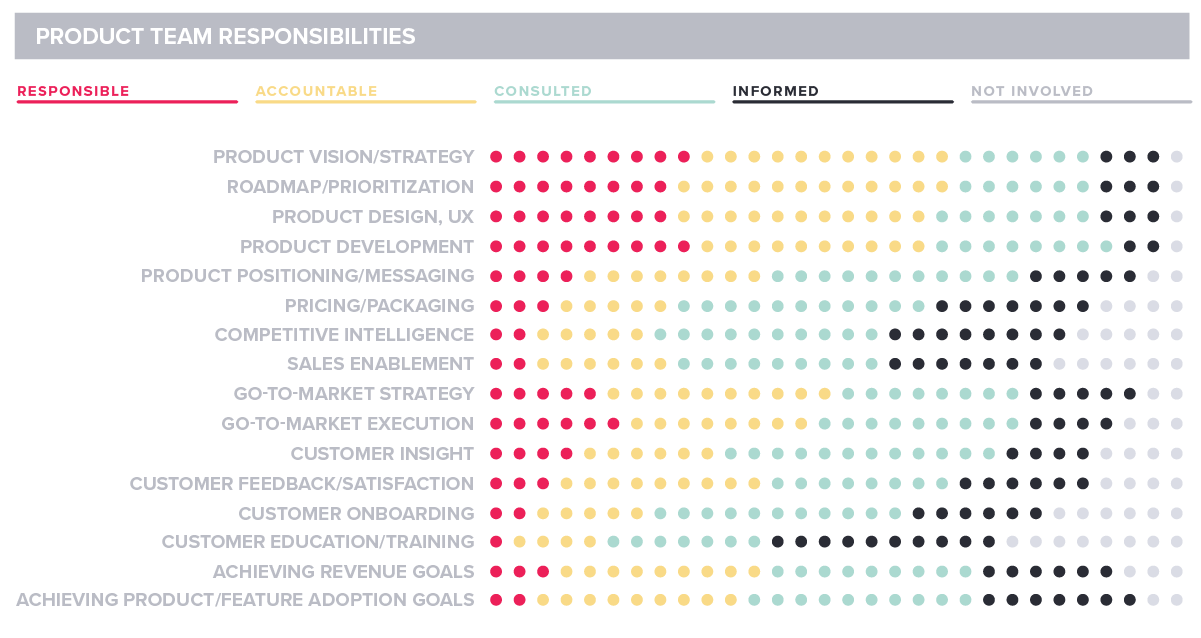

Last year’s survey suggested that product managers have perhaps broader responsibilities than you might imagine, with nearly half of respondents claiming to own go-to-market strategy for their companies. Candidly, this surprised us. But this year’s survey paints a decidedly more focused picture, with PMs focused largely on product strategy, design, and development.

This year, while PMs often remain every bit as involved, they report having less direct responsibility for revenue, adoption, customer education, and onboarding. This finding makes sense in light of the B2B focus of this particular study. Unlike B2C PMs, who generally own these functions, B2B product managers often rely on other teams here. We expect to see PM responsibilities expanding in these areas in subsequent studies.

Key Finding 2

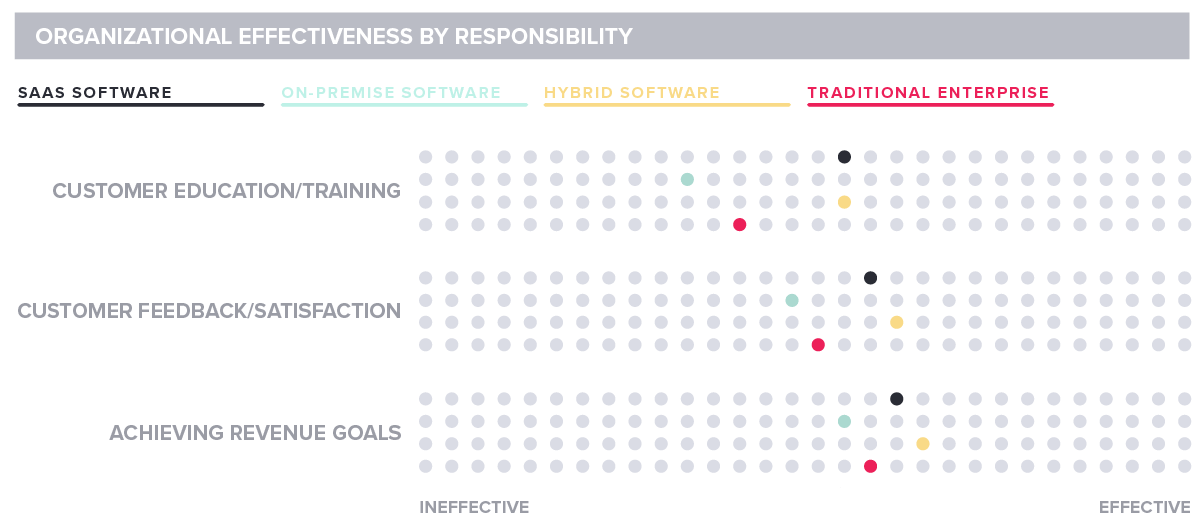

SaaS and hybrid product teams are much more focused on, and report higher levels of competency around customer engagement and retention.

SaaS product leaders know that growth depends on retention and retention depends on product use. SaaS has dramatically lowered switching costs for customers, which means that these companies in particular must be vigilant about customer engagement and retention. This year’s survey suggests that SaaS and hybrid companies, more than others, have relatively high confidence in their ability to manage the customer lifecycle to positive business outcomes.

Skill Sets

Key Finding 3

Product managers see themselves as more task-oriented than visionary.

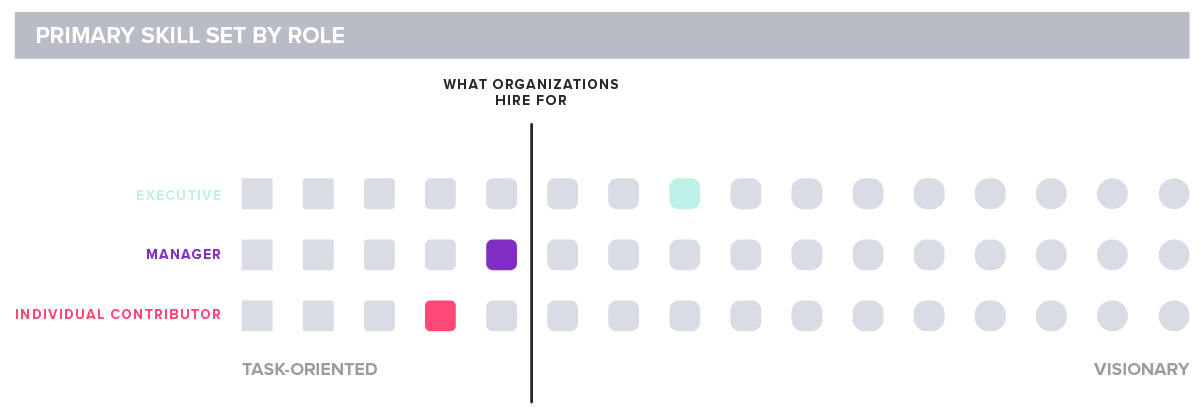

We asked survey respondents whether they consider themselves to be more visionary or task-oriented in their approach to managing products.

Not unlike last year, product managers largely self identify as more tactically oriented doers. Perhaps unsurprisingly, executives report being more visionary than managers or individual contributors, but they all lean toward task-orientation in their general outlook.

There’s no doubt that product management requires a whole lot of doing. But there’s a potential blindspot in all this busyness: failure to innovate. The best product managers create time and space for thinking beyond the pressing deadlines of the day.

Key Finding 4

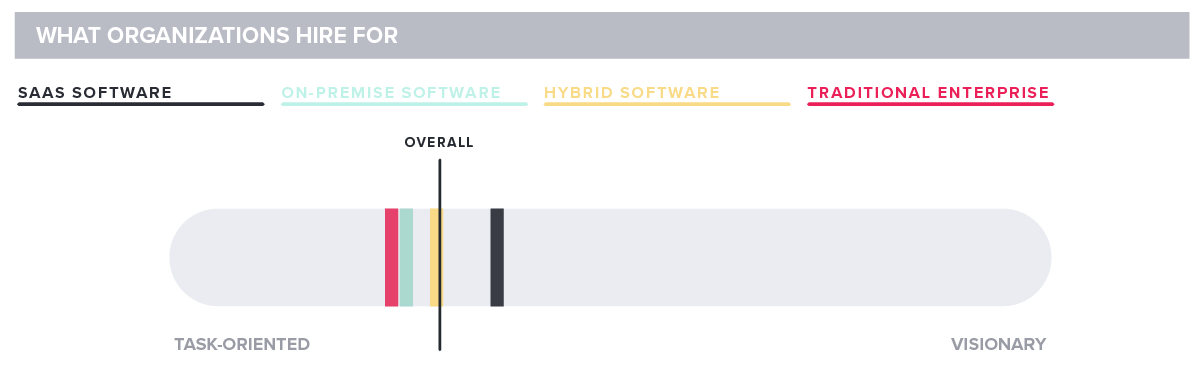

Companies value product managers who are more task-oriented.

It appears that companies also hire to this same profile. Of course, this may be an artifact of self-reporting where our respondents see their own attributes as an approximation of their company’s platonic ideal. It’s hard to know for sure. Either way, product leaders report that, in hiring PMs, their companies place a premium on practical doers over starry-eyed dreamers.

However, SaaS and hybrid software companies are a bit more likely to value visionary PMs. This makes sense when you consider the rapid pace of innovation, delivery, and expectation for a steady stream of differentiated value in SaaS-based product categories.

Organizational Alignment

Key Finding 5

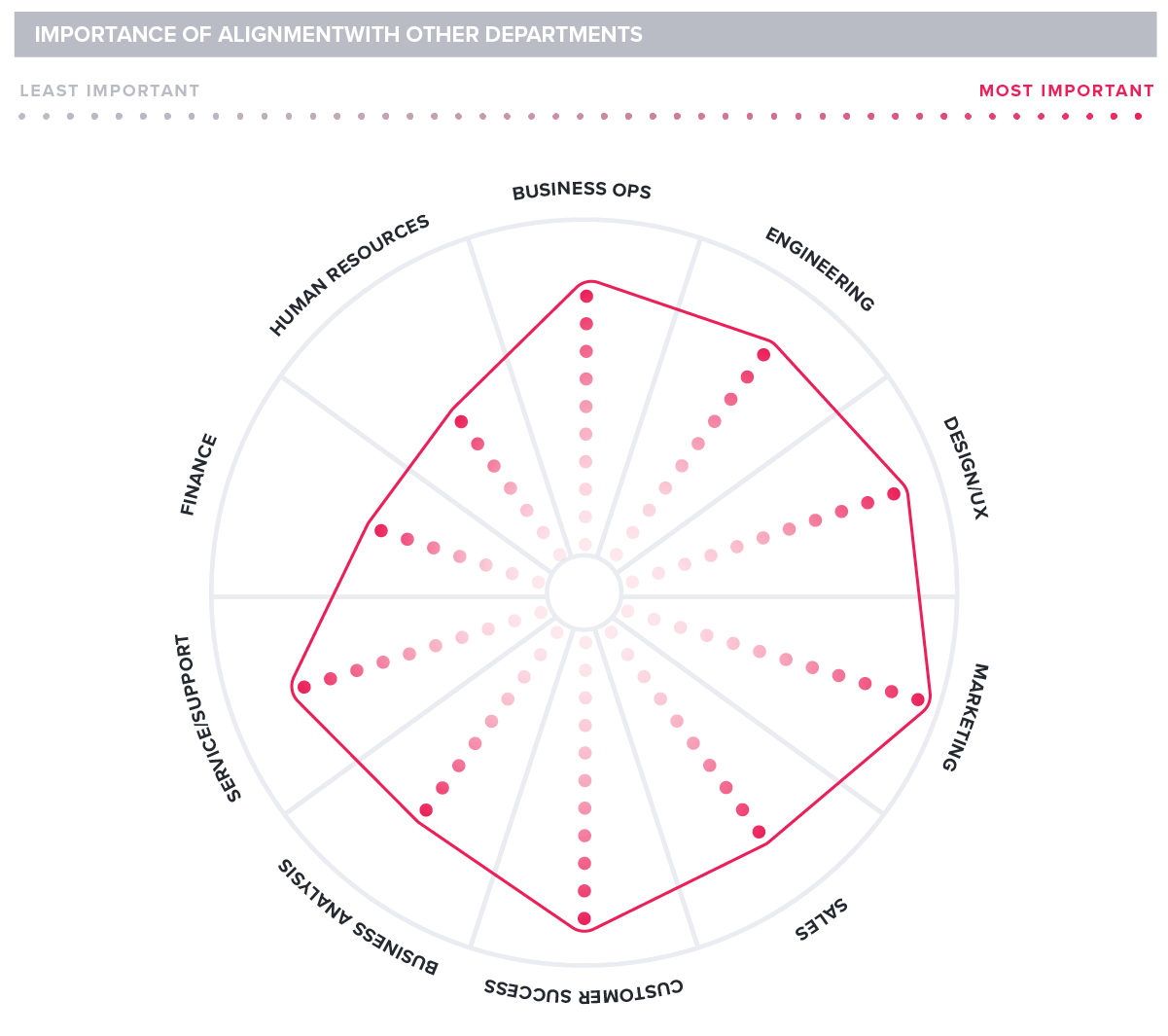

Product leaders prioritize alignment with marketing, UX, and customer success functions over engineering.

At first blush, this finding may seem surprising—or even alarming. Isn’t engineering PM’s core constituent? Of course, but we read this finding a bit differently. PM alignment with engineering is necessary, but insufficient. How products are designed; how they’re marketed and distributed; and how they’re made “sticky” for end users together comprise the holy trinity of modern software. It’s hard to find SaaS success without having these three things utterly nailed. Therefore, it makes sense that PM has prioritized bridge building in these particular areas.

One reason PMs are a bit less concerned with their engineering relationships is because they already see them as high functioning. Customer success, on the other hand, is another story. This is the area with the largest reported gap between importance and perception of current alignment. This should signal concern for any company dependent on recurring revenue.

Decision-making

Key Finding 6

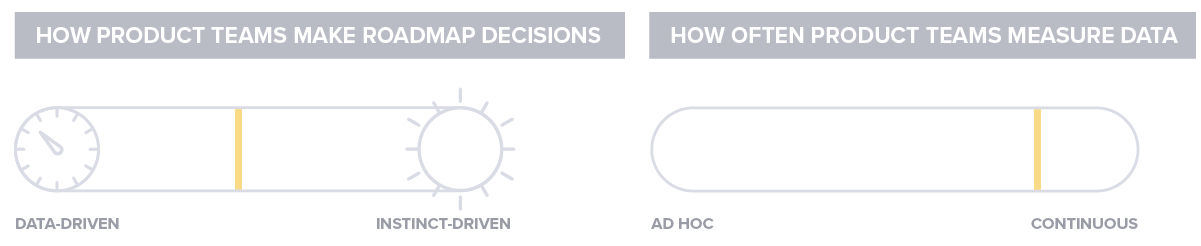

Data plays an important role for product teams. They increasingly utilize data in their decisions, and continuously measure their products.

Product managers used to rely heavily on their own gut instinct. Of course, they still do to an extent, and that’s not a bad thing. Product management is necessarily both art and science. But PMs increasingly see themselves as data-driven in how they make their roadmap decisions.

And while you might expect this data to be relatively episodic snapshots, product leaders tell another story. They see their data collection and measurement as more continuous in nature.

Key Finding 7

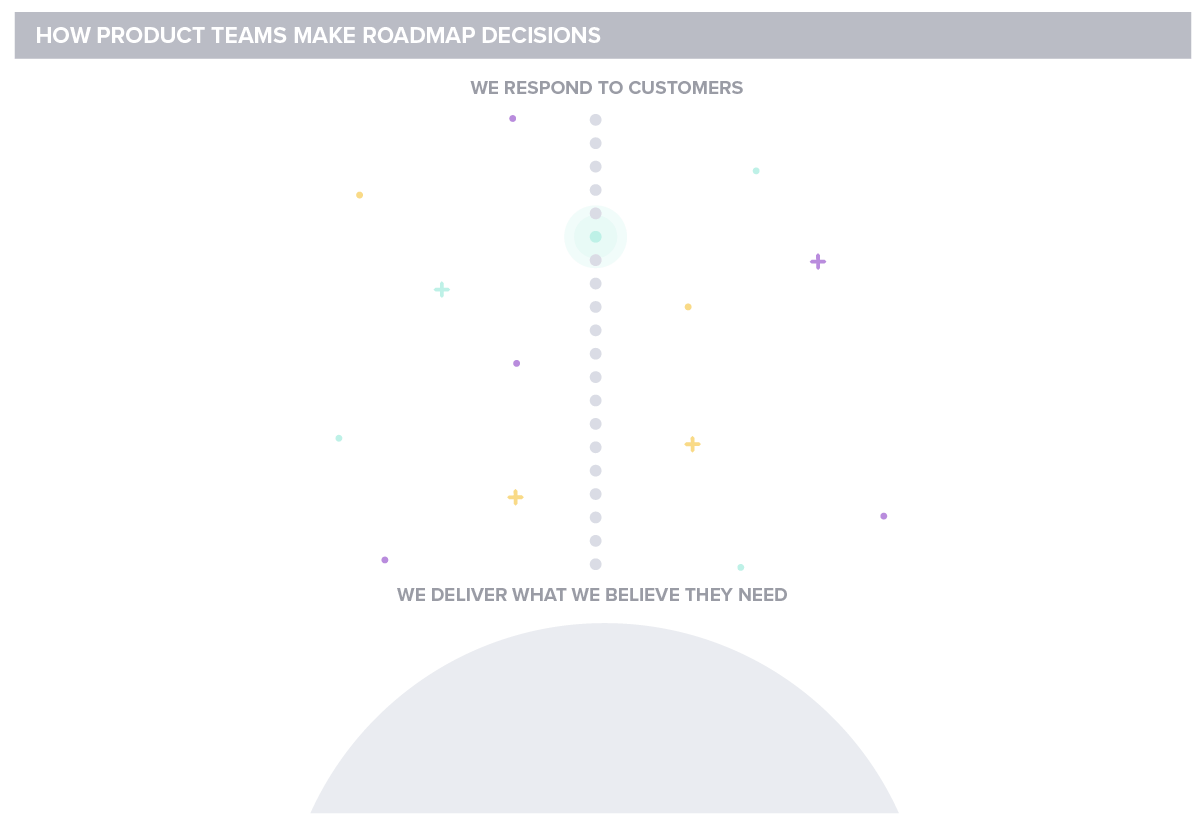

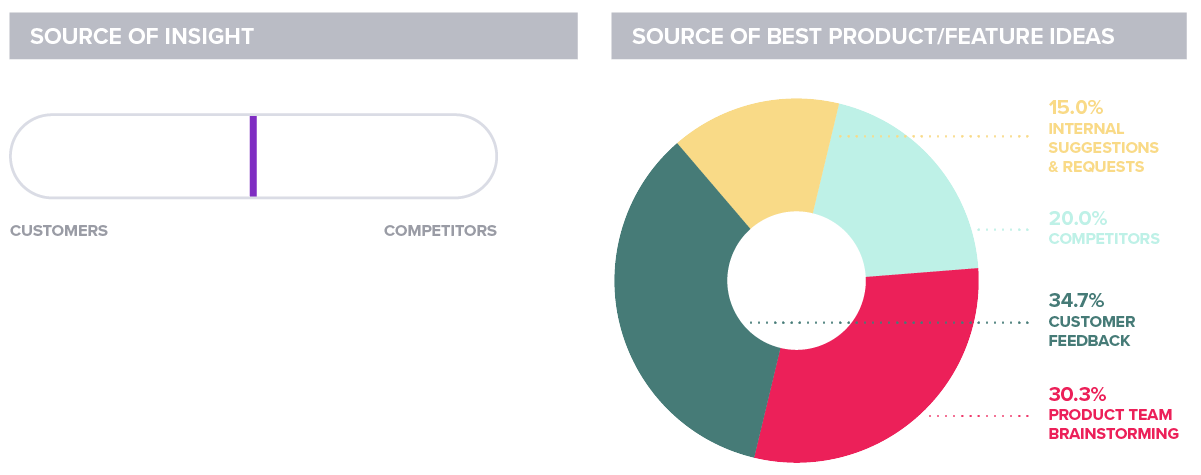

Customer needs serve as the ‘north star’ for most product leaders.

Steve Jobs famously rejected focus groups and other sources of customer feedback based on the notion that customers aren’t visionary enough to know what they want and need. According to our survey, product managers feel differently—a fact for which we are grateful. Product managers tell us they make roadmap decisions based on what they hear from their customers.

Last year’s responses to this same question gave us pause: respondents told us that their priorities were driven by competitors more often than by customers. We were pleased to see rationality prevail as the pendulum swung back in the direction of customers.

Tools Used

Key Finding 8

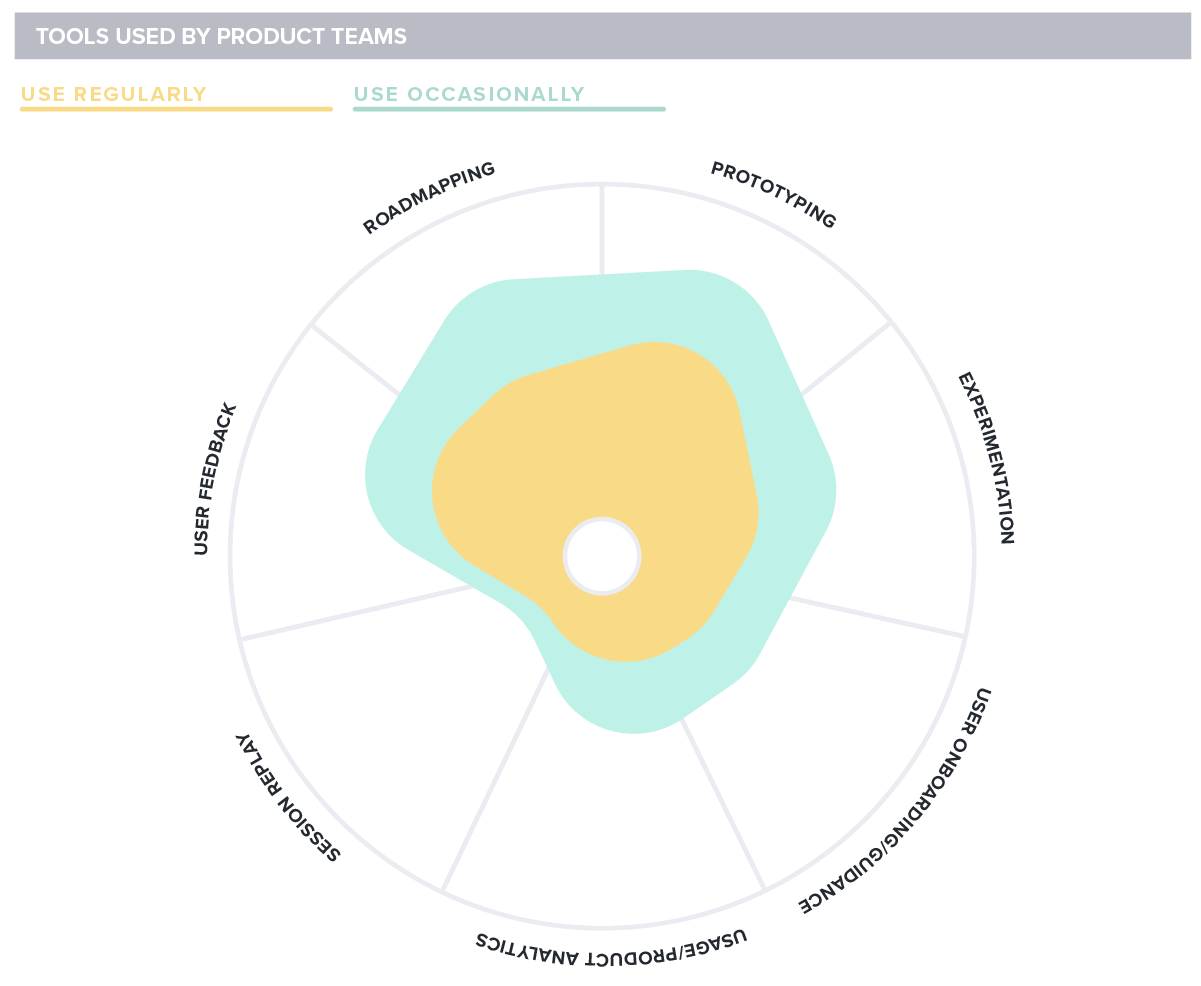

Product teams regularly use roadmapping, prototyping, and feedback/survey tools. They are less likely to use experimentation or onboarding tools.

Product managers regularly reach for roadmapping, prototyping, and user feedback tools, but they’re still getting the hang of newer tools, including product analytics, session replay, and user onboarding. Increasingly, SaaS companies rely on these type of tools to build predictable and profitable businesses by instrumenting the user journey for continuous insight and guiding users to find their way to value in the product. The reported gap in usage noted here is likely a result of the relative newness of these tools in the market and in the hands of B2B product teams.

Measurement and Performance

Key Finding 9

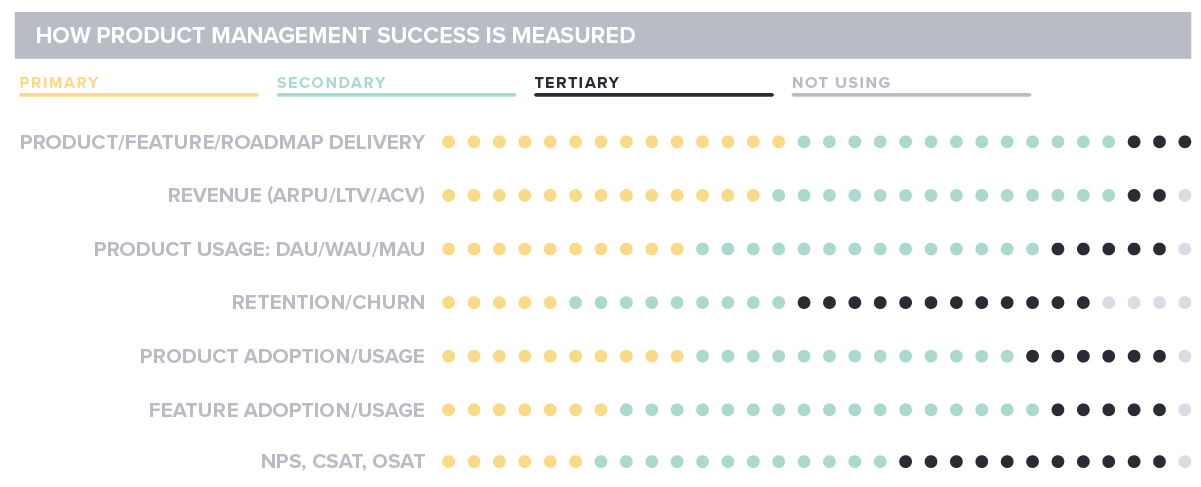

Product teams are still primarily measured on product/feature delivery, rather than user adoption or retention.

There was a time when product managers could declare victory—convincingly, even—once they shipped new features. Now they’re accountable for adoption, usage, value—and ultimately, profitable revenue—derived from these features. The goals that matter to product leaders should be the ones that align most directly to the business. However, this year’s survey suggests a slightly concerning view of KPIs, where PMs are still celebrating feature delivery over adoption, retention, and revenue. How are you measuring PM success? It may be worth a closer look.

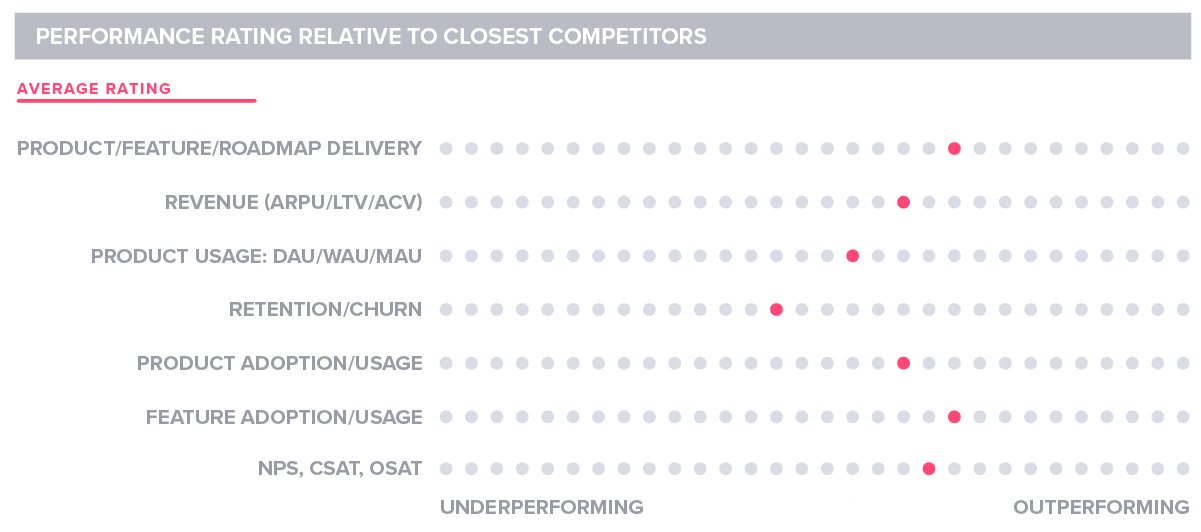

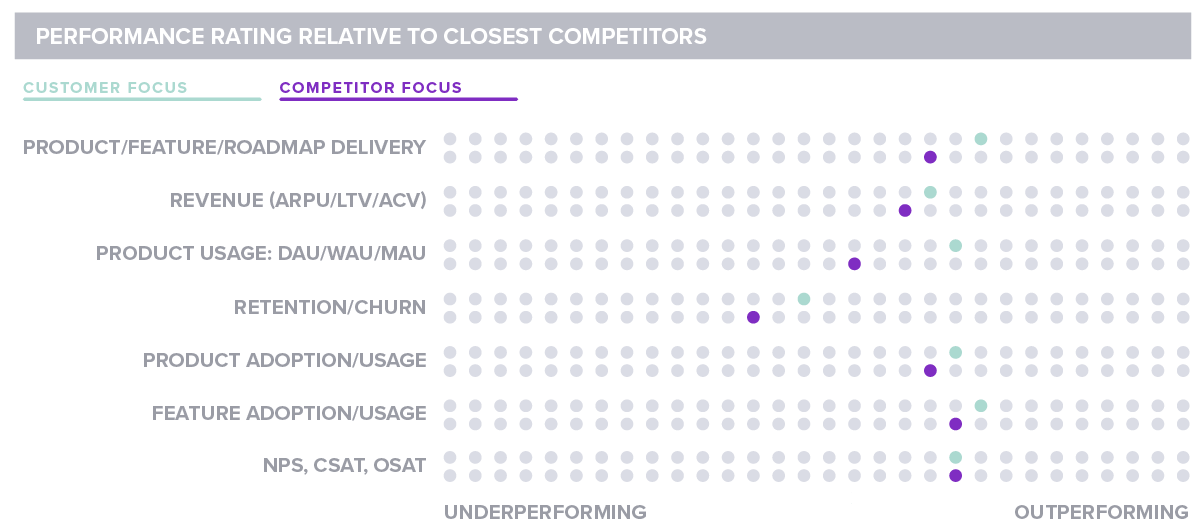

How are you doing relative to your competitors? Respondents struck a decidedly Lake Wobegon tone, suggesting that they’re above average in most everything—with the conspicuous exception of retention/churn. Again, it’s this intersection of product and customer success and the shared goal of retention that appears to be the most notable caution flag in this year’s survey.

Key Finding 10

Companies that value task-oriented PMs are better at product delivery, but worse at pretty much everything else.

This particular finding begs a vexing philosophical question: Are today’s PMs exercising old practices against new realities and expecting the same outcomes? This finding reveals that task-oriented PMs, which we’ve established are seen as the dominant and target-ideal archetype, are less effective at mostly everything except shipping products and features. But is it the shipping of products and features that are the keys to SaaS success? Let that one sink in.

Key Finding 11

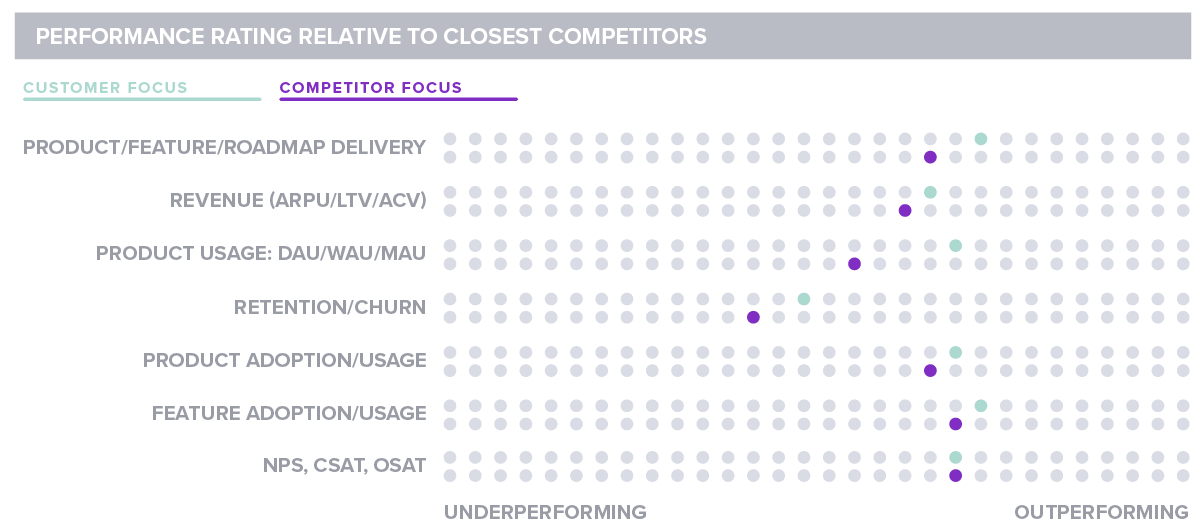

Product teams that respond to customers outperform those that focus on competitors when making decisions

This finding pretty much speaks for itself. The more you focus on customer needs, the more likely you are to outperform competitors. Remember that the next time your team finds itself in a checkbox arms race against some persistent competitor.

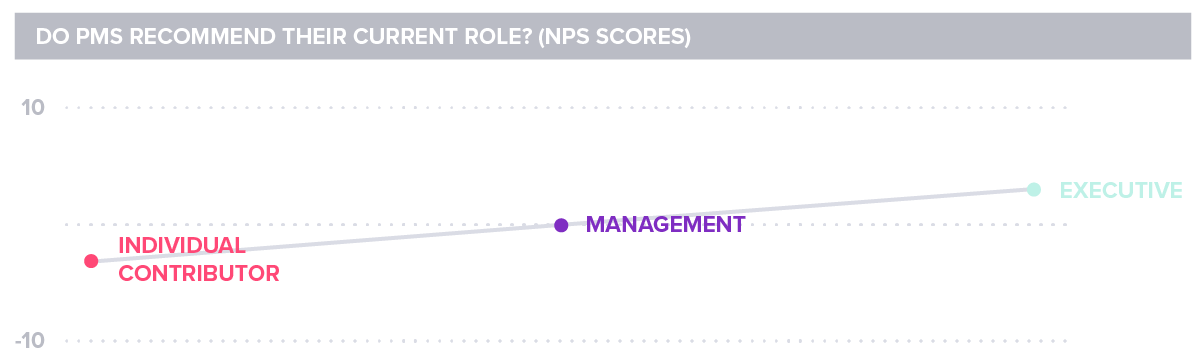

Job Satisfaction

Last year, we asked product managers whether they’d recommend their chosen career path. They responded with moderately high advocacy for the role, giving product management an NPS score of 20. This year, their enthusiasm was more muted, with an NPS score of 3, with slightly better scores from managers and executives. There was almost no difference in job satisfaction by reporting line, but PMs with a technical background say they’re a bit happier in their roles. It makes you wonder whether the low job satisfaction is a function of the various misalignments we’ve discussed throughout this study.

Key Finding 12

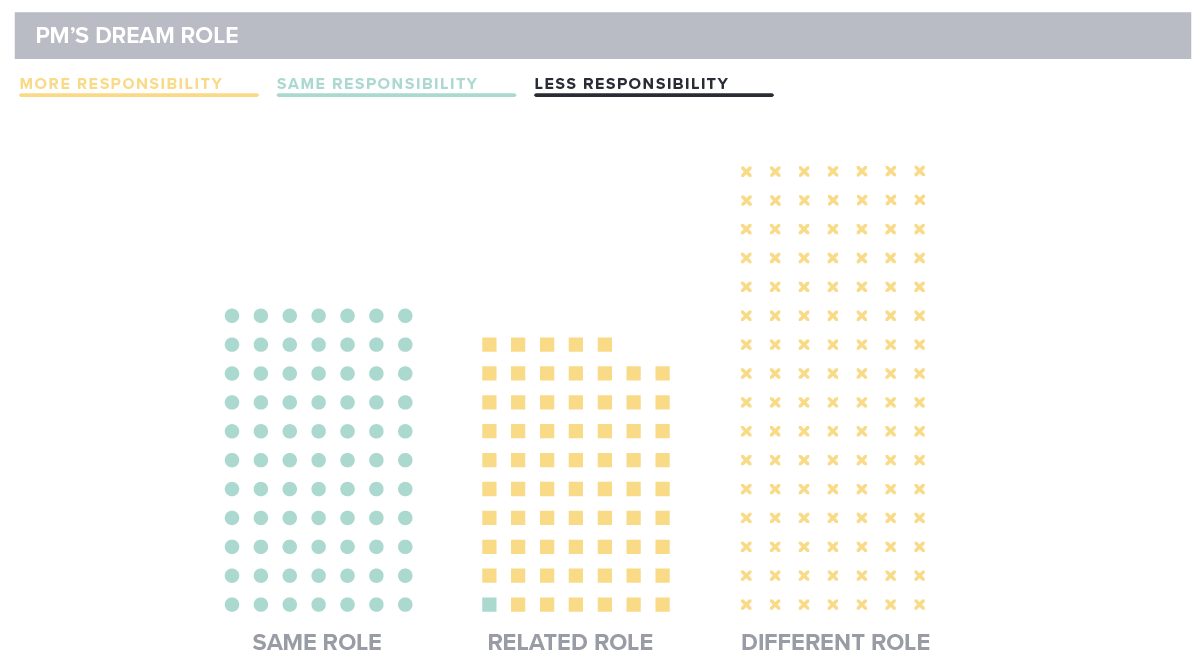

Many product leaders say their ideal job involves some other role … with a lot more responsibility.

Consequently, it appears that many product managers are considering their options. Significantly more respondents say that their ideal job is in another discipline—with more responsibility. On average, PMs are an ambitious lot, with plenty of passion to spare. We all know that product managers lead by influence, not formal authority. Perhaps what we’re seeing here are their ambitions frustrated by this reality. Put another way, maybe what we’re seeing is the debunking of the old trope that PMs are the CEOs of their product.

We hate to end on such a down note. This finding should be instructive, not defeating. Product management is, by

virtually all accounts, a role very much on the rise. What does that mean? More and more expectation of product managers—often without the formal authority, sphere of influence, or span of control to affect change. That’s a recipe for frustration. This all signals a role in transition. As product management gains a seat at the table it needs the authority to match.

Recommendations

1. Mind the gaps—one of the more notable themes from this year’s survey relates to alignment gaps between product management and customer success, particularly around the shared goal of customer retention. Take a closer look at your PM and CS functions. Are these teams communicating and collaborating enough? Are feature requests and customer issues surfaced and prioritized appropriately? Do these teams have a mutual plan and a shared set of KPIs around customer retention?

2. Revisit KPIs—shipping new features naturally feels like an accomplishment—and it is. But is that the primary goal for a SaaS company? Remember: where the metric goes the effort flows. Be sure your teams are oriented to downstream goals better aligned to measures of value and growth: adoption, usage, satisfaction, retention, and expansion.

3. Create a growth plan—respondents signaled some frustration in their roles in this year’s survey. Likely contributors are the misalignments with key functions and metrics noted above as well as limited span of control and sphere of authority. Be sure you’re setting PMs up for success by allowing them the influence and authority to deliver on the expectations laid at their feet and giving them a growth plan for career progression.

4. Reconsider reporting lines—the most mature product organizations are led by a c-level executive with a seat at the table. Where does product report in your organization? As business advantage increasingly bends toward innovation and design, do your current reporting lines give product the central focus and attention it deserves? Does it situate product as close as possible to the customer and the market? Unless you can answer these questions with an unequivocal yes, consider restructuring this year.

5. Look to B2C for inspiration—B2B PMs need to think di erently as consumer buying behaviors and experience expectations expand into their world. Customers bring their consumer expectations to work. Thus, B2B product managers should look to the best B2C applications and experiences to inform how they build their own products. Simple, intuitive, personalized, inviting, and delightful—these should be the watchwords for—and characteristics of—any product whether it’s designed for business or consumers.

The 2020 Report is here!

The 2020 report contains 10 new findings with five actionable recommendations that will help you put some of these learnings into practice.